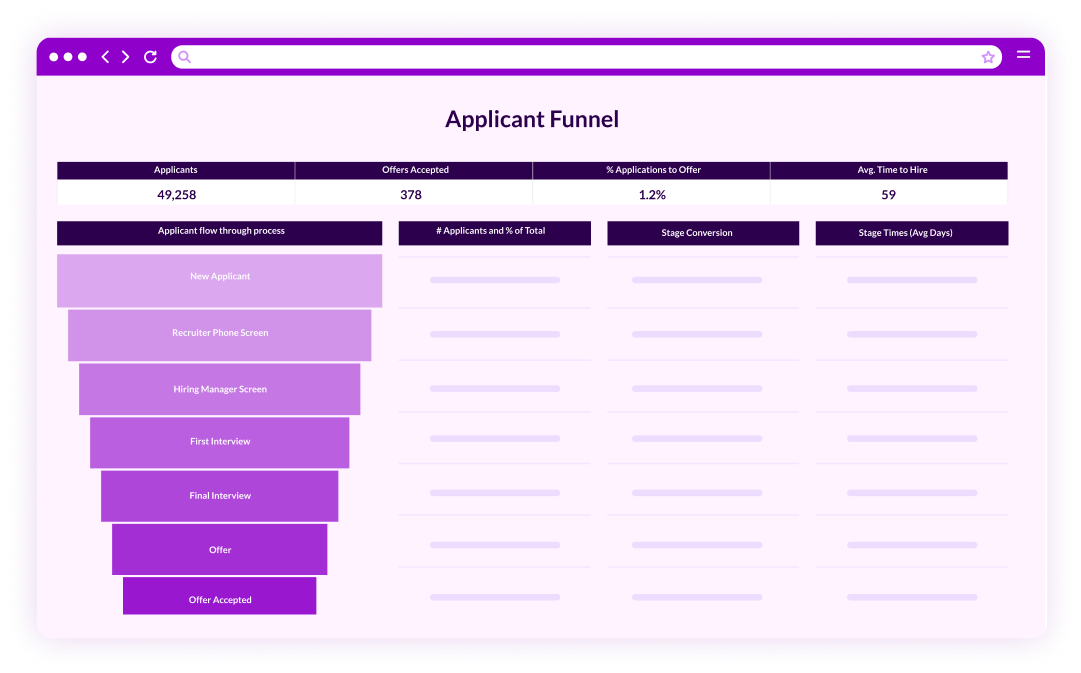

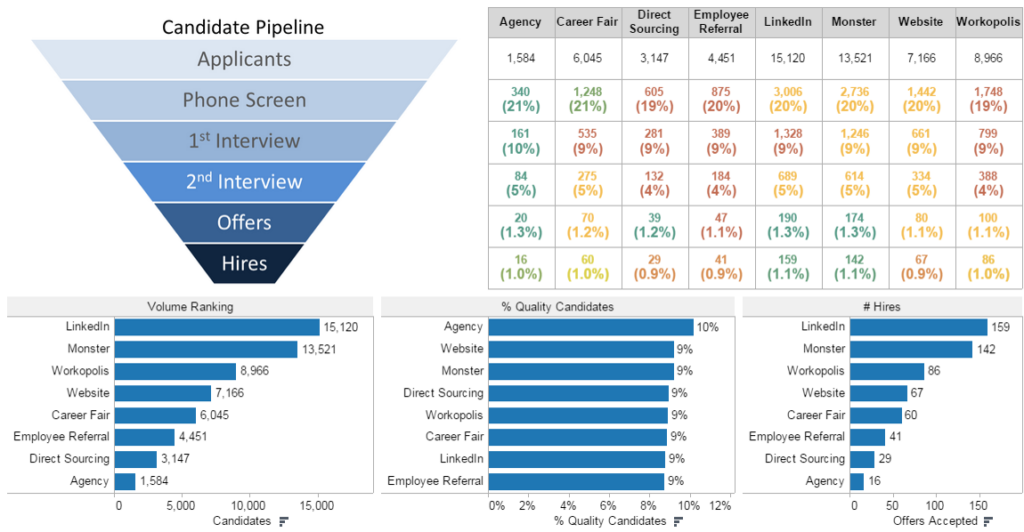

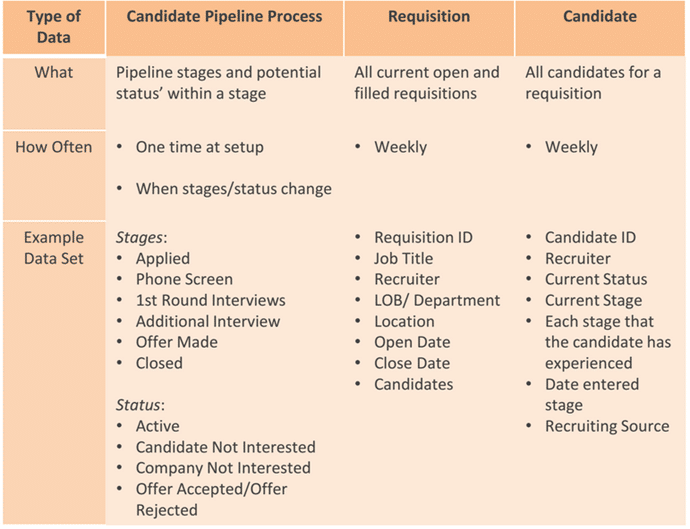

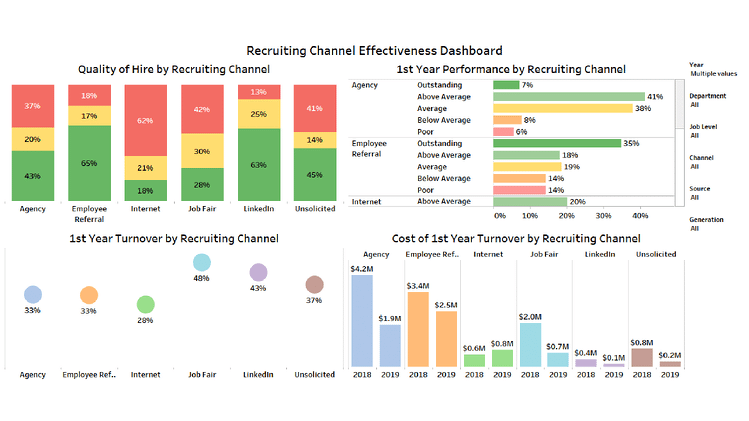

Getting started with talent acquisition analytics can be daunting. There’s lots of data from disparate systems and little time to determine how to use it effectively. But when you do, you’ll improve your ability to attract, progress and hire quality candidates.

A stepped process prioritized by key business questions ensures a fast start. Know it evolves over time. Also know that the experts at HireRoad can help. Let us show you how.